Contáctenos

Quiénes somos

Ver todo

- Quiénes somos Quiénes somos

- Misión

- Nuestro equipo directivo

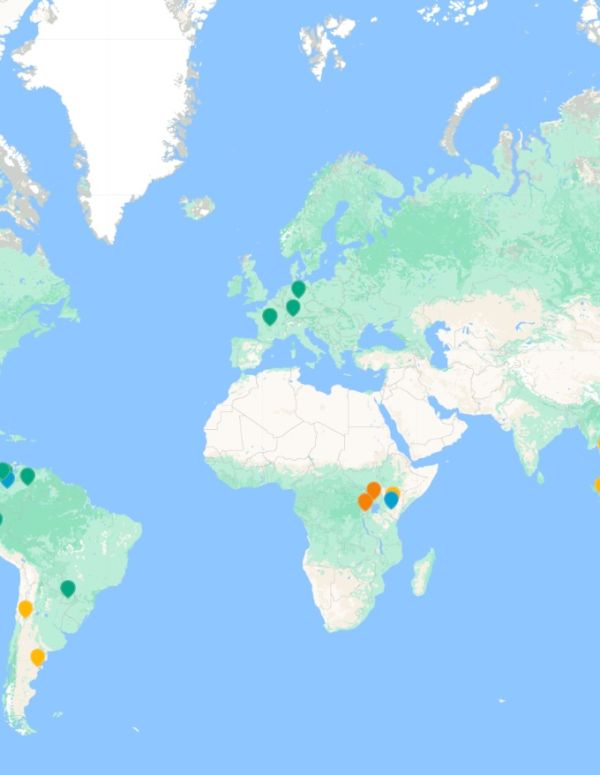

- Nuestras sedes

- Nuestro compromiso con la integridad

Nuestro compromiso con la integridad

Comienza hoy tu camino por el liderazgo climático

Leer más

- Quiénes somos Qué hacemos

- Consultoría climática

- Certificados medioambientales

- Financiar la descarbonización a escala

Nuestro compromiso con la integridad

Comienza hoy tu camino por el liderazgo climático

Leer más

- Quiénes somos Nuestro Impacto

- Clientes

- Descubra nuestros proyectos

Nuestro compromiso con la integridad

Comienza hoy tu camino por el liderazgo climático

Leer más

Nuestro compromiso con la integridad

Comienza hoy tu camino por el liderazgo climático

Leer más

Qué hacemos

Ver todo

- Qué hacemos Consultoría climática

- Navegue por la normativa medioambiental: mida su impacto climático, informe y evalúe sus riesgos cli

- Fixez des objectifs fondés sur la science et préparez durablement votre transition vers le net zéro

- Descarbonización de la cadena de suministro

Créditos de carbono y financie la acción climática

Net Zero - Su camino empieza aquí.

Conozca más

- Qué hacemos Certificados medioambientales

- Comprenda los mercados en rápida evolución y planifique una cartera preparada para el futuro.

- Elija créditos de carbono y certificados medioambientales listos para su compra.

- Asegure un flujo a largo plazo de créditos de carbono

Créditos de carbono y financie la acción climática

Net Zero - Su camino empieza aquí.

Conozca más

- Qué hacemos Financiar la descarbonización a escala

- Finance decarbonisation at scale

- Descubra nuestros proyectos

Créditos de carbono y financie la acción climática

Net Zero - Su camino empieza aquí.

Conozca más

Créditos de carbono y financie la acción climática

Net Zero - Su camino empieza aquí.

Conozca más

Nuestro Impacto

Ver todo

- Nuestro Impacto Clientes

- Ver todo

Nestlé

Comienza hoy tu camino por el liderazgo climático.

Read more

- Nuestro Impacto Sectores

- Aviación y aerolíneas

- Energía/Servicios públicos

- Industria de la moda

- Sector financiero

- Alimentos y Bebidas

- Sector Público

- Bienes raíces

- Ver todo

Nestlé

Comienza hoy tu camino por el liderazgo climático.

Read more

- Nuestro Impacto Descubra nuestros proyectos

- Soluciones Basadas en la Naturaleza

- Proyectos de Comunidades y agua limpia

- Energía renovable

- Transformación de residuos en energía

- Soluciones de gestión de plásticos

- Ver todo

Nestlé

Comienza hoy tu camino por el liderazgo climático.

Read more

Nestlé

Comienza hoy tu camino por el liderazgo climático.

Read more

Eventos y Noticias

Ver todo

- Eventos y Noticias Noticias

- Noticias

- Boletín de prensa

El reporte de net zero de South Pole de 2024

Al día con el cambio climático

Comienza hoy tu camino por el liderazgo climático.

Conozca más

- Eventos y Noticias Eventos

- Próximos Eventos

- Eventos pasados

El reporte de net zero de South Pole de 2024

Al día con el cambio climático

Comienza hoy tu camino por el liderazgo climático.

Conozca más

- Eventos y Noticias El blog de South Pole

- Descifrando la comunicación climática: claves para el éxito empresarial

- Cinco razones para invertir en energías renovables

- Prepara tu negocio para el cumplimiento de la CSRD

- The evolving definition of integrity in the carbon market

- Ver todo

El reporte de net zero de South Pole de 2024

Al día con el cambio climático

Comienza hoy tu camino por el liderazgo climático.

Conozca más

- Eventos y Noticias Publicaciones

- Todas las descargas

- Ver todo

El reporte de net zero de South Pole de 2024

Al día con el cambio climático

Comienza hoy tu camino por el liderazgo climático.

Conozca más

El reporte de net zero de South Pole de 2024

Al día con el cambio climático

Comienza hoy tu camino por el liderazgo climático.

Conozca más

Quiénes somos

Qué hacemos

Nuestro Impacto

Eventos y Noticias

Nuestro compromiso con la integridad

Créditos de carbono y financie la acción climática

Nestlé

El reporte de net zero de South Pole de 2024

Al día con el cambio climático