Kontakta oss

- Vilka vi är

- Vad vi gör

- Vårt Inflytande

- Event och Nyheter

- Karriär hos South Pole

- Vår digitala klimatplattform Luumo

Vilka vi är

Visa alla

- Vilka vi är Om oss

- Uppdrag

- Ledning & Styrelse

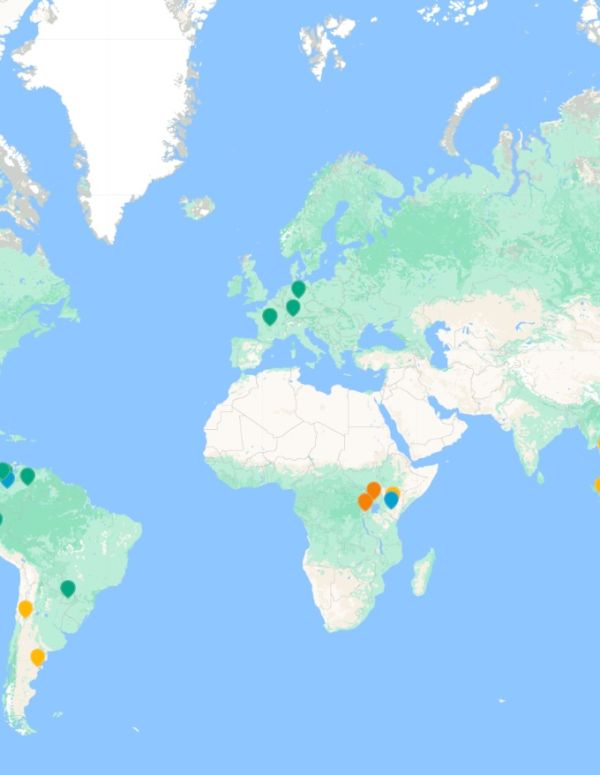

- Våra kontor

- Integritet

Vårt integritetsarbete

Påbörja din klimatresa idag

Läs mer

- Vilka vi är Vad vi gör

- Klimatrådgivning

- Miljöcertifikat

- Finansiera utfasning av koldioxidutsläpp i stor skala

Vårt integritetsarbete

Påbörja din klimatresa idag

Läs mer

- Vilka vi är Vårt Inflytande

- Våra kunder

- Upptäck våra projekt

Vårt integritetsarbete

Påbörja din klimatresa idag

Läs mer

Vårt integritetsarbete

Påbörja din klimatresa idag

Läs mer

Vad vi gör

Visa alla

- Vad vi gör Klimatrådgivning

- Navigera i miljölagstiftningen: mät din klimatpåverkan, rapportera och bedöm dina klimatrisker, allt

- Sätt upp vetenskapligt baserade mål och bygg resiliens

- Minska utsläpp i leverantörskedjan:Engagera intressenter och minska Scope 3-utsläpp

Finansiera klimatåtgärder via koldioxidkrediter

Nettonoll - Din resa börjar här.

Läs mer om

- Vad vi gör Miljöcertifikat

- Förstå de snabbt föränderliga marknaderna, planera en framtidssäker portfölj.

- Köp tillgängliga klimatkrediter och miljöcertifikat

- Säkra en långsiktig ström av koldioxidkrediter

Finansiera klimatåtgärder via koldioxidkrediter

Nettonoll - Din resa börjar här.

Läs mer om

- Vad vi gör Finansiera utfasning av koldioxidutsläpp i stor skala

- Finance decarbonisation at scale

- Upptäck våra projekt

Finansiera klimatåtgärder via koldioxidkrediter

Nettonoll - Din resa börjar här.

Läs mer om

Finansiera klimatåtgärder via koldioxidkrediter

Nettonoll - Din resa börjar här.

Läs mer om

Vårt Inflytande

Visa alla

- Vårt Inflytande Våra kunder

- Se alla

Nestlé

Påbörja din klimatresa idag.

Läs mer

- Vårt Inflytande Sektorer

- Aviation and airlines

- Energi/Försörjning

- Modeindustrin

- Finansiella sektorn

- Mat och Dryck

- Offentlig sektor

- Fastigheter

- Se alla

Nestlé

Påbörja din klimatresa idag.

Läs mer

- Vårt Inflytande Upptäck våra projekt

- Naturbaserade lösningar

- Samhällen och rent vatten

- Förnybar energi

- Avfall-till-energi

- Lösningar för plast

- Se alla

Nestlé

Påbörja din klimatresa idag.

Läs mer

Nestlé

Påbörja din klimatresa idag.

Läs mer

Event och Nyheter

Visa alla

- Event och Nyheter Nyheter

- Senaste Nyheterna

- Pressmeddelande

2024 års Net Zero rapport från South Pole

Catching up with Climate

Påbörja din klimatresa idag.

Läs mer här

- Event och Nyheter Event

- Kommande event

- Tidigare Event

2024 års Net Zero rapport från South Pole

Catching up with Climate

Påbörja din klimatresa idag.

Läs mer här

- Event och Nyheter South Pole blogg

- Är din kommunikation kring klimatåtgärder tillräckligt bra?

- FLAG - SBTi:s strategi för fastställande av mål för den markintensiva sektorn tas i bruk

- Förbered dig inför den dubbla väsentlighetsanalysen – nästa steg i CSRD-rapporteringen

- The evolving definition of integrity in the carbon market

- Se alla

2024 års Net Zero rapport från South Pole

Catching up with Climate

Påbörja din klimatresa idag.

Läs mer här

- Event och Nyheter Publikationer

- Alla nedladdningar

- Se alla

2024 års Net Zero rapport från South Pole

Catching up with Climate

Påbörja din klimatresa idag.

Läs mer här

2024 års Net Zero rapport från South Pole

Catching up with Climate

Påbörja din klimatresa idag.

Läs mer här

Vilka vi är

Vad vi gör

Vårt Inflytande

Event och Nyheter

- Är din kommunikation kring klimatåtgärder tillräckligt bra?

- FLAG - SBTi:s strategi för fastställande av mål för den markintensiva sektorn tas i bruk

- Förbered dig inför den dubbla väsentlighetsanalysen – nästa steg i CSRD-rapporteringen

- The evolving definition of integrity in the carbon market

- Se alla

Vårt integritetsarbete

Finansiera klimatåtgärder via koldioxidkrediter

Nestlé

2024 års Net Zero rapport från South Pole

Catching up with Climate